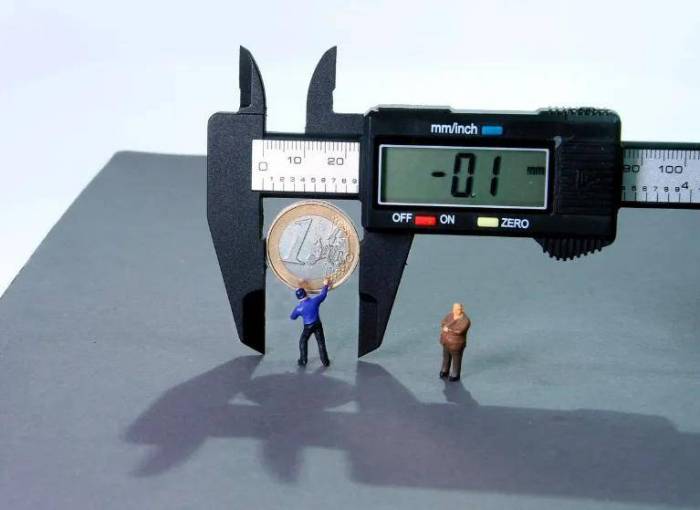

Is "0 Interest" on Deposits Coming?

2024-06-26

In recent announcements from the central bank, the one-year and five-year loan prime rates (LPR) have remained steadfast at 3.45% and 3.95%, respectively. This marks four consecutive months without a reduction in interest rates, which many consumers and investors had anticipated.

While a downward adjustment in the mortgage rates for existing loans has not materialized, what we are witnessing is a noticeable drop in deposit rates. As we approach the middle of the year—a critical juncture for banks eager to bolster their performance metrics—some banks are surprisingly lowering their interest rates.

On May 29, the Guangdong Chenghai Rural Commercial Bank announced changes to its Renminbi deposit rates, effective June 1. Post-adjustment, the rates for three-year and five-year fixed deposits saw decreases of 20 basis points and 25 basis points from last November’s rates. Other smaller banks, including Guangxi Binyang Rural Commercial Bank, Henan Xiping Zhongyuan Village Bank, Hubei Jingmen Rural Commercial Bank, and Hubei Yicheng Rural Commercial Bank, have also followed suit, trimming their Renminbi deposit rates over the past month.

Advertisement

The trend of lowering interest rates isn’t confined to rural banks; during December last year, many state-owned banks undertook widespread reductions. The once-prominent high-yield deposit products have nearly disappeared, signaling a significant generational shift in the interest rate landscape.

Furthermore, the well-known Tianhong Yu'e Bao money market fund has seen its seven-day annualized yield plummet to 1.4860%, dipping below the 1.5% threshold—the lowest point since December 20, 2022. This trend hints at the possible onset of a prolonged low-interest-rate era.

According to Zhu Ning, the vice dean of Shanghai Jiao Tong University's Shanghai Advanced Institute of Finance, the economic miracle that China has experienced over the past thirty years has led many investors to perceive high-speed economic growth and elevated investment returns as the norm. Consequently, continuous growth in gross domestic product (GDP), skyrocketing real estate prices, and rising wealth have created a false sense of security among many investors who now struggle with the unfamiliarity of stagnation or decline in these areas.

The first group to feel the effects of this new reality may be those who identify with the FIRE movement—an acronym for Financial Independence, Retire Early. This concept, which gained traction in the United States in 1992 due to the efforts of author Vicki Robin and Wall Street analyst Joe Dominguez, advocates for the aggressive accumulation of wealth to enable early retirement, ideally before the age of 35.

Reflecting on the past decade, individuals who subscribed to the FIRE philosophy enjoyed what could be described as a lucrative "joy ride." The original proponents of this movement outlined a simple formula: if one saved 25 times their annual expenditure and achieved an annualized return of at least 4% through prudent asset allocation, they could then rely on passive income to cover basic living expenses.

In China, the FIRE movement made its entrance around 2015, finding fertile ground among the younger generation eager to reclaim autonomy over their lives. For instance, a Chinese individual who had saved 1 million yuan by 2014 could generate 30,000 yuan in interest income through a fixed deposit with a 3% annualized interest rate—exceeding the national average disposable income for urban residents, which was about 29,381 yuan that same year.

These calculations represent conservative estimates, especially considering the emergence of products like Yu'e Bao, which at its peak offered annualized returns of up to 7%. Even individuals with less than the aforementioned 1 million yuan would have ample opportunities to achieve financial independence.

Fast forward ten years, and the same financial strategies now yield only 14,500 yuan, significantly falling short of the current average disposable income of 39,218 yuan.

This fluctuation underscores a vital principle in the investment landscape: change is constant, and high-interest rates are not permanent. The landscape of financial products has shifted dramatically, with past successes now brimming with disappointment.

In light of declining interest rates, a new era of financial asset turbulence is emerging. The once-promising real estate up cycle is fading away, equity markets are experiencing increased volatility, and investments in gold have been erratic, influenced by fluctuating inflation data in the U.S.

The recent surge in demand for long-term bonds, particularly those with 30- to 50-year maturities, reflects two opposing trends: a profound desire for low-risk investments and rising concerns about the continued decline of interest rates.

Despite the volatility in financial markets, this multi-round reduction in deposit rates has not dissuaded consumers from maintaining their deposits. As the macroeconomic environment undergoes significant transitions, investors are left questioning how to manage their asset allocations wisely.

Going forward, in this low-interest-rate environment, it is imperative for investors to adopt proactive strategies that diversify their portfolios, balancing risks alongside potential returns. However, determining what assets to invest in remains a complex challenge.

On one hand, the Chinese A-share market has yet to establish a robust foundation of investor confidence. On the other, many investors and potential entrants to the market face considerable obstacles to stepping outside their comfort zones. The high volatility sectors can potentially offer high returns, yet the fear of losses casts a long shadow over investment decisions.

When risk assets offer little more than exposure to uncertainty, capital tends to gravitate toward the safety of bank deposits and government bonds.

Indeed, many domestic investors currently find their choices constrained to long-term government bonds, a somewhat passive selection. However, low yields, combined with competitive demand, mean that purchasing government bonds at inflated prices could lead to losses.

As such, if an investor seeks to secure long-term, stable returns, it is essential to engage with burgeoning industries. They must identify sectors poised for sustained growth and glean benefits from their long-term development, rather than shifting sporadically between short-term products that only contribute to added costs.

Identifying sectors with potential growth and aligning with government policies is crucial at this juncture. One of the most promising industries is the aging population sector. The discussion around “elderly care” has emerged as a focal point during this year’s national meetings, with the government report referencing the issue 13 times. Recent conferences have elevated the importance of aging finance to unprecedented levels.

Owing to demographic shifts, the National Health Commission predicts that by 2035, over 400 million people aged 60 and above will reside in China, accounting for more than 30% of the total population—a substantial leap into a heavily aging society.

As the “baby boomer” generation from 1962 to 1973 retires, society faces an escalating demand for various elder care services, including nursing homes, healthcare facilities, senior products, rehabilitation aids, and smart health solutions. The multi-faceted and high-quality demand for elder care presents an inviting opportunity for societal capital and enterprises to partake in expanding this industry. Thus, the elder care sector is positioned to experience significant growth.

In this context, the phrase “sunset industry” seamlessly transforms into a “sunrise industry.” Investments that align with elder care needs could indeed represent a solid path toward securing long-term benefits.

Leave a Reply